As a septuagenarian, one doesn’t quite look forward to financial crises, but this is exactly what Ahmedabad-based Joginder Bakshi found himself facing in 1999. After a failed business venture, his retirement nest egg was all but destroyed, but he managed to regain his footing soon after by reverse mortgaging his house with a leading public sector bank.

As a septuagenarian, one doesn’t quite look forward to financial crises, but this is exactly what Ahmedabad-based Joginder Bakshi found himself facing in 1999. After a failed business venture, his retirement nest egg was all but destroyed, but he managed to regain his footing soon after by reverse mortgaging his house with a leading public sector bank.

“I was in a financial mess, but didn’t want to depend on my son, so I decided to mortgage my property. Now, every month, I get a fixed amount from the bank, and the best bit is that I still get to live in my house,” says the 74-year-old Bakshi.

What is reverse mortgage?

For the uninitiated, reverse mortgage is a loan that enables home owners above 60 years of age to convert a part of their self-owned home equity into income without having to sell it. Under the scheme, the bank determines the value of the property and fixes a percentage of its current value as loan amount. This is based on parameters such as the likely lifespan of the senior citizen and his spouse. Typically, the loan amount is 60-70% of the market value of the property. The applicants have the option oftaking the loan as a lump sum or a fixed monthly amount. After the death of the senior citizen, the surviving spouse can continue to occupy the property till his/her demise. The value of the property is periodically reevaluated by both the parties, the owner and the bank. If the valuation has increased, the applicants are given the option of increasing the quantum of the loan.

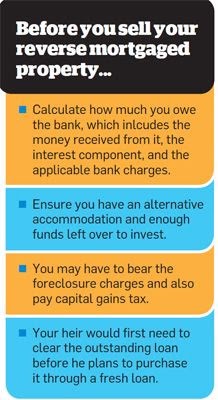

However, one should be prepared to shell out money for charges like processing, valuation, as well as legal fees for availing of the loan. The processing charges are usually around 0.5% of the loan amount, with the maximum limit of Rs. 10,000. The valuation and legal charges may add up to between Rs. 5,000 and Rs. 10,000 depending on the loan amount.

“The bank has told me that in case of my demise, it will give two options to my heirs. They can choose to pay the outstanding amount, along with the interest component, to redeem the property. Alternatively, the bank will sell off the property to recover its dues and the surplus money, if any, will be passed on to my heirs,” says Bakshi.

Leave a comment